by Miriam Kurtzig Freedman, J.D

Illustrations by Daphne San Jose

The language of the who, what, where, when, why, and how of wills.

Who are the players? Note: Some terms have a masculine and feminine form:

MALE testator administrator executor heir

Testator, testatrix: The person making the will.

FEMALE testatrix administratrix executrix heiress

Decendent:

A person who has died. The people inheriting property under a will or through intestacy are called by various terms.

Beneficiary:

A person or organization entitled to receive property from a will (or from a trust or insurance policy).

Heir, heiress:

A person or institution who will inherit - either because he is named in the will or because he is entitled to inherit from the decedent by law.

Issue:

Descendants, children, grandchildren, et cetera.

Next of kin:

The people closest to the decedent in blood relationship. Also, people who will receive property because of their relationship (under the laws of intestacy). The people who have various functions under a will or through intestacy include the following:

Administrator/administratrix:

Someone named by a court to manage the estate of a decedent who dies without leaving a will.

Custodian:

A general term. Anyone who has charge (custody) of property, papers, or persons (such as minor children). Sometimes called a conservator.

Executor/executrix:

A person named in a will to manage the decedentís estate. Also called a personal representative.

Guardian:

A person named in the will or by the court to care for a minor child or a person who has been decreed by a court to be not competent to care for himself. Sometimes also manages property. These persons serve with or without bond.

Bond:

A guarantee to pay money to persons damaged or hurt by the failure of the person in position of trust, such as a trustee, executor, administrator, or guardian, to carry out his legal and ethical duty.

Bonds are written by bonding or surety companies. Their cost is based on the value of the estate.

Will:

The document, signed by the testator and witnessed according to law where the testator is domiciled, which explains how he wishes to have property distributed after death, who should care for minor children, et cetera. To be valid a will must be written and executed (signed/ witnessed/completed) according to the law of the testatorís domicile. Also called the last will and testament, if you care to get fancy!

Estate:

All property-real and personal-that a person owns when he dies.

Gift:

Property given in a will. There are two types of gifts.

Elect against the will:

All states allow a surviving spouse to ignore the provisions made for him in the will (if any) and choose instead the financial allocation provided in the stateís statutes. Usually, these give him one half or one third of the estate.

Inherit:

To receive property from a decedent either through a will or through intestacy.

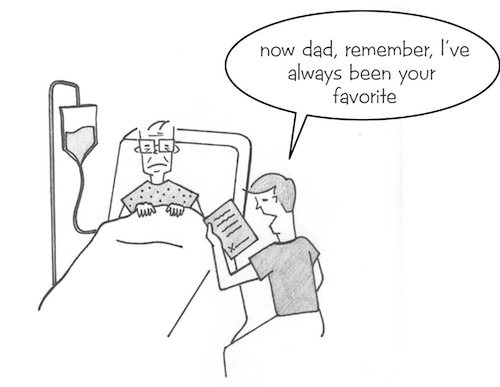

Disinherit:

A testator can intentionally omit a legal heir who would normally have a right to inherit, such as a child. Children can be disinherited in most states, but spouses cannot.

Legacy:

general, specific, and residuary gifts of personal property (bequests) in a will. A general legacy gives a specified amount of money, but its source is unspecified. ìI give one thousand dollars to Andrew.î A specific legacy gives a designated property. 'I give the antique diamond to Kate'; or 'all stock in Corporation X to Kennethî; or 'all moneys in First National Bank to Aaron.' A residuary legacy is all the bequests remaining after other legacies have been distributed. 'I give all that remains to Jonah.'

Domicile:

The place where a person has his principal home. The will is probated where the person lived when he died. That's where the will is written.

There are two relevant time periods: before death and after death.

You write a will in order to be testate: to die with a valid will. In this way the testator/testatrix decides how the estate is to be distributed. Otherwise you die intestate.

To be intestate:

To die without a valid will. In case of intestacy the estate is distributed according to state law, generally to close family members, next of kin. State officials appoint a guardian for young children. A sample common order of intestacy: spouse, children, parents, siblings, nieces and nephews, and other next of kin.

Escheat:

If a person dies without a will and has no relatives who qualify to inherit, the property escheats to the state. It goes to the state! It does not go to a lifelong companion or best friend or favorite charity. Doesnít this word sounds like what it means!

Death tax, inheritance tax, transfer tax, estate tax:

All mean approximately the same thing; a tax levied by state and federal governments on the decedentís property, above a certain amount. For example, after 1987 the federal estate tax exemption is six hundred thousand dollars. That is, no taxes are paid on the first six hundred thousand dollars of an estate. Taxes and exemption amounts differ from state to state, of course.

Intent:

A very important legal concept in this area of the law as well as many others. If a dispute develops about the will, the court will attempt to determine the decedentís intention when he wrote the will in order to carry out those wishes. The critical question will be: What did the decedent intend to do? As you can imagine, this is not easy to determine if a will is ambiguous.

Home - The Little Law Book - Legal Grind®

EliteAttorneys.com

2640 Lincoln Blvd, Box 6

Santa Monica, CA 90405

310.452.8160

info@eliteattorneys.com